List Of Deductions Allowed In 2022

List Of Deductions Allowed In 2022

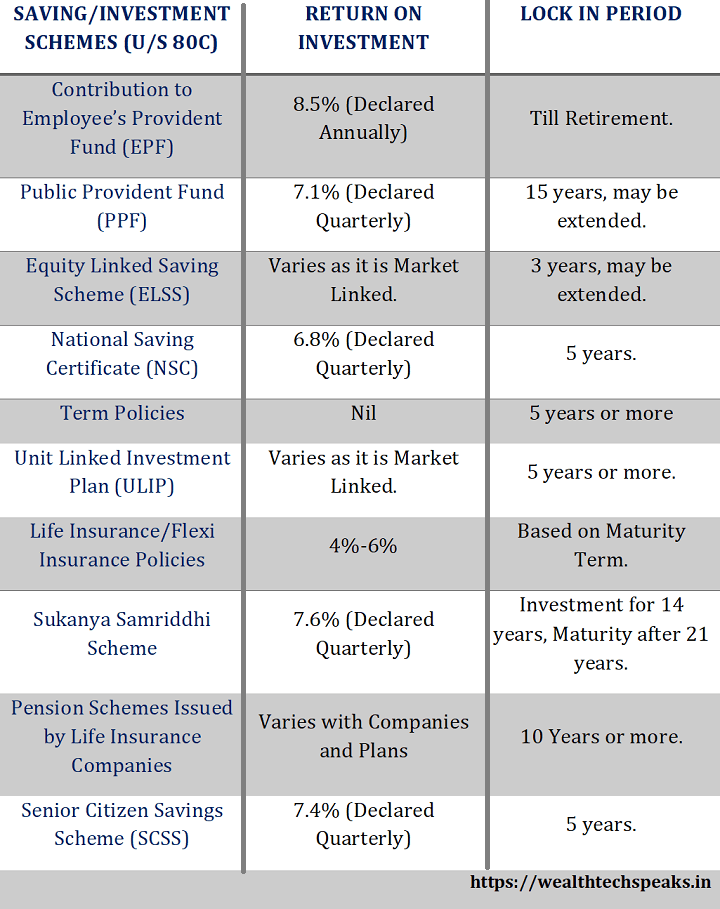

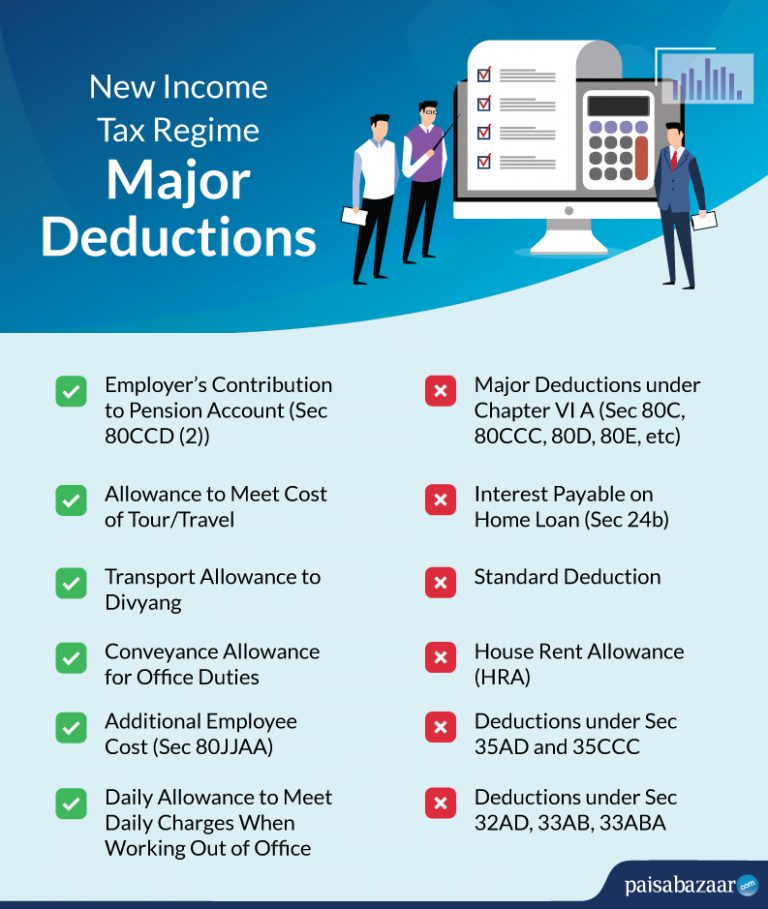

Also find out the deduction under Section 80D for FY 2021 - 22 AY 2022 - 23 from Goodreturns. List of tax deductions and allowances retained in the New Tax regime section 115BAC Allowanes retained under Sec115BAC are as below-. Deductions under Sec80C like Life Insurance Premium Sum Paid towards deferred annuity plans your contributions towards EPF PPF Superannuation Scheme SSY NSC ELSS Mutual Funds Tuition Fees Principal Payment towards your home loan Tax Saving FDs SCSS Contribution to NPS Tier 2 by Central Government Employees NPS contribution by you Under Sec80CCD 1 and. Deduction in respect of life insurance premium contribution to PF children tuition fees PPF etc.

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

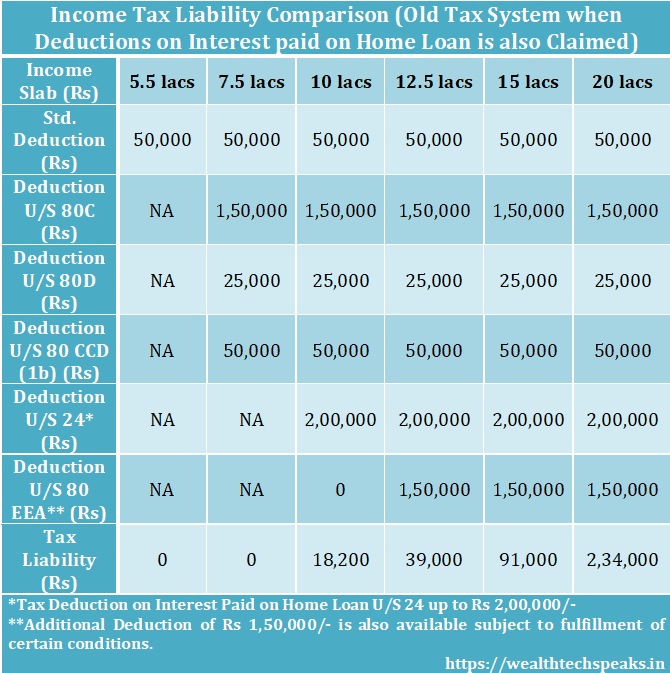

House rent allowance Leave Travel Allowance Standard Deduction of Rs 50000 Deduction available under section 80TTA Deduction in respect of Interest on.

List Of Deductions Allowed In 2022. Section 80C deductions claimed for provident fund contributions life insurance premium school tuition fee for children and various specified investments such as ELSS NPS PPF can not be availed. Salary Basic DA if part of retirement benefit Turnover based Commission. As announced in the Budget additional deduction of Rs 150000- is available on affordable housings up to the value of Rs 45 lakhs.

The most commonly claimed deductions under section 80C will go. The standard deduction applicable for persons in employment against salary income cannot be claimed when the taxpayer who opts for section 115BAC. This is not applicable if you are occupying the only house you own.

B 40 of Salary 50 if house situated in Mumbai Calcutta Delhi or Madras c Rent paid minus 10 of salary. Below is the list of the main tax exemptions and deductions that are not available for the tax payers if you opt for the new regime. A Actual HRA Received.

Income Tax Deductions Financial Year 2020 21 Wealthtech Speaks

Income Tax Deduction Exemption Fy 2021 22 Wealthtech Speaks

New Tax Regime Complete List Of Exemptions And Deductions Disallowed Basunivesh

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Health Insurance Sec 80d Tax Deduction Fy 2020 21 Ay 2021 22

Income Tax Deduction Exemption Fy 2021 22 Wealthtech Speaks

Rebate Under Section 87a Ay 2021 22 Old New Tax Regimes

Income Tax Comparison New Vs Old Fy 2021 22 Wealthtech Speaks

Income Tax Slab Rates For Fy 2021 22 Budget 2021 Highlights

Income Tax Slab Rates For Fy 2021 22 Budget 2021 Highlights

Income Tax Rates For Individual For Ay 2021 22 Old Vs New

List Of Income Tax Deductions Fy 2020 21 Under New Old Tax Regime Finmedium

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Income Tax Benefits Available To Salaried Persons For A Y 2022 23

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

Top 10 List Of Income Tax Deductions For Ay 2021 22 For Salaried Employees Tax Benefits On Payments Investments And Incomes The Financial Express

Section 80d Deduction For Medical Insurance Preventive Check Up Tax2win

Post a Comment for "List Of Deductions Allowed In 2022"